Renters Insurance in and around Hagerstown

Hagerstown renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your jewelry to your boots. Wondering how much coverage you need? That's okay! Tim Panther is ready to help you consider your liabilities and help pick the appropriate policy today.

Hagerstown renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

There's No Place Like Home

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Tim Panther can help you with a plan for when the unpredictable, like an accident or a fire, affects your personal belongings.

There's no better time than the present! Get in touch with Tim Panther's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Tim at (301) 733-1712 or visit our FAQ page.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

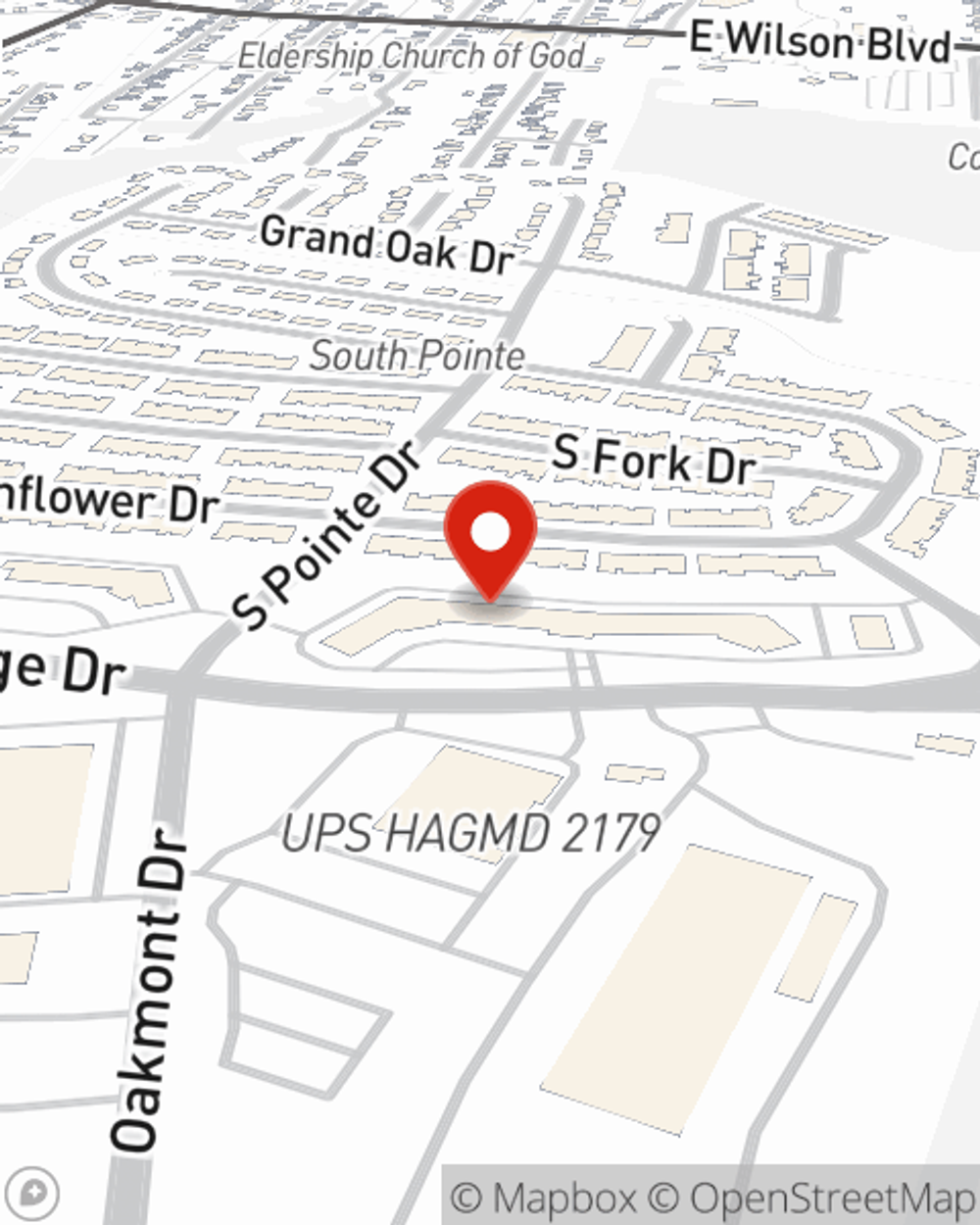

Tim Panther

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.